1. Project Introduction

Official Twitter:https://twitter.com/opyn_

Opyn is an ethereum-based decentralized derivative protocol platform that allows users to gain revenue by trading options or providing liquidity. Opyn allows users to buy, sell and create options on ERC20, which is a no-escrow options protocol and a no-license insurance protocol.

Now, the Opyn team has shifted its focus to a new direction, Squeeth.

Squeeth is simple and straightforward, the underlying is ETH ^2(ETH square) without holding period limitation and no leverage if you long the Squeeth. What surprise me is that the Squeeth adds gamma in the strategies and solves the roll down problem by Perpetual Concept.

Ok, let's dive into the details about Opyn.

Financing:

2020, $2.16M, Lead investor: Dragonfly

2021, $6.7M, Lead investor: Paradigm Series A

Team:

2. Strategies

If you would like to participate directly in the investment,Opyn provides three way : Long , Short and Crab strategy; if you are seeking for some quasi passive-active investment, LP may be suitable.

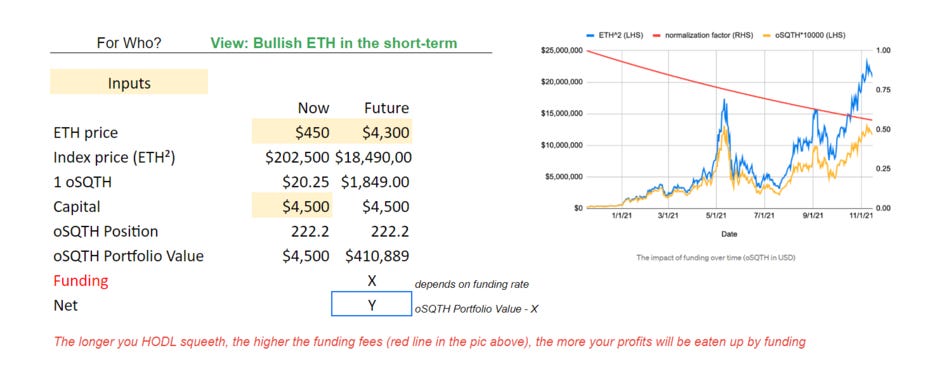

2.1 Long only

ETH buy oSQTH, the underlying is ETH ^2 ( like an index, gamma > 0, delta > 0)

Open position: swap ETH to oSQTH

Close out: swap oSQTH to ETH (UNI or Opyn platforms)

Position: Long oSQTH

Long squeeth return ≈ 2r + (r)² - funding

Example :

(Read the data from Google spreadsheet link:https://docs.google.com/spreadsheets/d/1_xt6F8SSSOyJ7AwVCswrjJKFTZ_cx6IvCS3rtwSuJgM/edit#gid=804401548)

It should be noted that:

funding rate will be paid daily ( Long side paid to the Short side)

in-kind

not suitable for long-term investments (because the red line will reduce the rate of return continued, unless there is an exponential level of the bullish market)

2.2 Short only

This situation is a little more complicated.

Short position will be required to collateralize a minimum investment of 6.9 ETH, CR (collateral multiplier, between 150% - 300%, below 150% will trigger liquidation)

Open position: Collateralized ETH, get funding rate (gamma < 0, delta < 0)

Close out: Eliminate the contract and redeem ETH

Position: Short oSQTH

Shortsqueeth return ≈ -2r - (r)² + funding + CR*r eth

CR return:because the collateralized ETH is belong to youself, you share the gain spontaneously.

Example :

When the market is stable : gain

or market's volatility is high: loss

(Read the data from Google spreadsheet link:https://docs.google.com/spreadsheets/d/1_xt6F8SSSOyJ7AwVCswrjJKFTZ_cx6IvCS3rtwSuJgM/edit#gid=1886503241)

Short oSQTH has negative delta and gamma, so there will be a negative skew loss in longer time or in a extreme market situation.

The good thing is that there is funding and collateralized ETH gains to offset some of the losses (in an up market)

It is not selective among retail investors because of the threshold limit of at least 6.9 ETH .

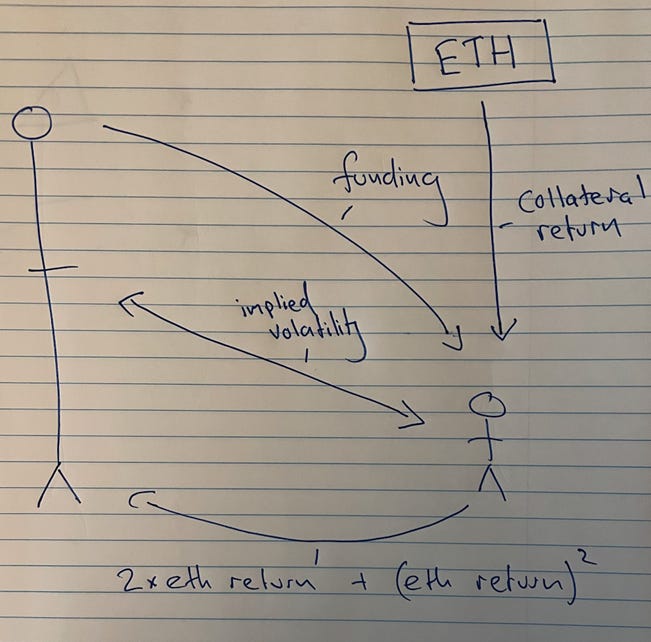

Summary: The below illustration describes this long short two-sidedsituation

Or in the form of counterparties.

Essentially, long or short strategy is just like a swap of implied volatility and bet on the directiont. If your opinion is stable and price wil down - short it ,or volatile and price will rise - long it.

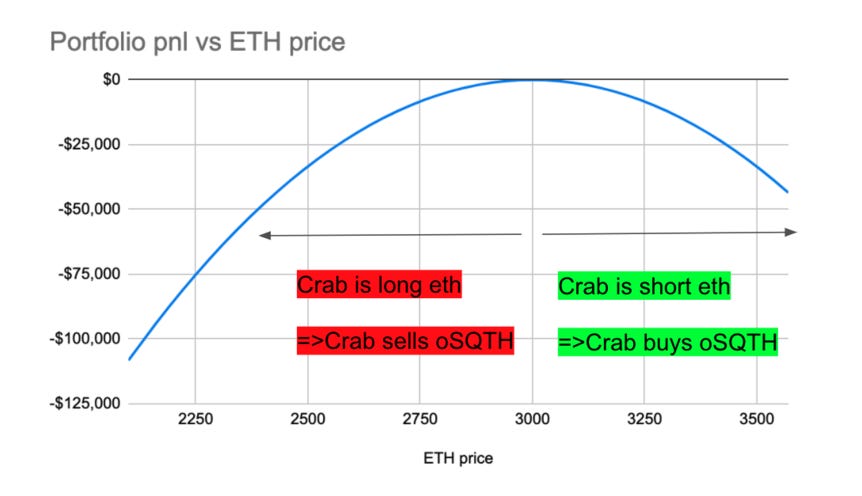

2.3 Crab Strategy (long /short strategy)

The Crab strategy is a new sideways period strategy launched on Opyn.

Position : long ETH + short oSQTH (delta hedge, gamma < 0 )

Dynamic adjustment (here is a derivation with a link:https://colab.research.google.com/drive/1R7aMIIWRTm1qEztww3rEUOfZB-kL4dUW#scrollTo=oqc7fgcW5jfj).

Equivalent to an autonomous stabilizer or buffer belt,because of delta hedge.

Essentially, Crab is a Short implied volatility strategy.

Yield (days) : Crabreturn = funding - (ETH return)²

Yield(annualized): E(Crab apy) = 365funding - (variance of eth )*

The following graphic illustrates that you can make a gain in green area:

Arbitrage: Crab Auction

There are two types of crab auctions, "buy" and "sell", which are used to balance the crab strategy.

「Participating in the squeeth crab auction」

Crab proof calculation form: https://docs.google.com/spreadsheets/d/1EOofU20IZFtPKlFsg1spaUrtTefLXYDKRtJ9vhMJVGE/edit#gid=46994367

The easy way to gain:

If ETH price rises → strategy to buy oSQTH with WETH

If ETH price falls → strategy to sell oSQTH for WETH

Summary:

From a long-term holding perspective, the crab strategy is a concave strategy with left-skewed risk;

however, the crab strategy improves the barrier to entry for those shorting oSQTH to some investors;

in the short term, the crab auction offers short-term arbitrage opportunities, and the sustained income funding rate will improve the return curve.

2.4 LP

Increase liquidity into ETH/oSQTH pair in the UNI pool.

There are two ways: Buy & LP and Mint & LP

If you have bullish opinion on oSQTH, the Buy and LP approach will be your priority. Since the nature of the LP ETH position on UNI is not fully invested in oSQTH, the return curveis similar to tracking an index ETH ^1.5 (a partial long oSQTH position) The return curve is as follows.

The alternative way is Mint and LP, the process is to exchange ETH for oSQTH, and then LP on UNI.

Covered call(writing a covered call) : the position is long ETH + short oSQTH( collateralized ETH ,swap to oSQTH and LP)

Similarly LP will reduce the Long ETH position, and short oSQTH with negative convex properties, and oSQTH tracking ETH ^1.5 curve, a long time to see, the negative convex effect will become more and more obvious. The return curve is as follows,

Why is tracking a ETH ^1.5 index? - because the LP requires an equal amount of USD of the ETH /oSQTH coin party.

3 Highlights and Tradeoffs

3.1 Highlights and Outlook

Highlights:

Opyn's squeeth solves two problems: roll down and convexity.

As shown in the column:

The rollover problem is solved by the perpetuity theory, where the party with the longside pays funding rate to the short side .

On the derivation of the theory of perpetuity: 「Everlasting Options」

Using the square of the price of ETH as a tracking index creates a convexity (gamma)

Why gamma is important? - Simple clarification: positive gamma means when the price rise you gain more and when the price down you lose less (Bravo, that is what the longsides love).

More strategy combinations to attract more professionals; e.g., demanders of gamma hedge;

Outlook:

Possibility of more derivative combinations appearing after the Opyn platform is open to bear and bull strategies ;

Corss platformsto: other derivative platformsto work with each other as derivative portfolios.

3.2 Tradeoffs

In terms of options platforms, the** profitability is unknown **(or limited)

The obsolescence of the products is a concern (v1, v2 options products are failed)

In terms of strategy: the **barries of derivatives **is high and not suitable for ordinary investors ;

The current strategy content is still too single, more like a prototype;

The lack of liquidity (Weaknesses common to defi projects)

All strategies point to Short-term and arbitrage, not very friendly to long term investors.

4. Summary

I love the team's creativity because they are the first one who makes a gamma index in defi. That's why I called them may be a defi strategy inventor. At last ,let me conclude the Pros way and my concerns.

Pros :

The creation of the index ETH^2 and the introduction of Gamma, there are two challenges in the crypto sapce from the market point of view.

One is to attract more professional investors to participate (more professional derivatives traders can have a wider range of options)

Another is more derivatives combinations can emerge (such combinations as their own platform products, or may be cross-platform products) although a very small change, but it does broaden the variety and combination of ways in the derivatives market.

The professionalism , innovation and leading investor of the project is great, and I am extremely looking forward to their Bull strategy and Bear strategy.

Concerns:

How to lower the threshold for investors ?

How to expand the number of customers?

How to inform and educate clients?

How to simplify the investment process?

How to make a simple and easy to understand product?

How to capture market share?

Will they be able to maintain their professionalism and innovation in the future?

Again, looking forward to the noval solution from the brilliant team in the near future.

References:

Crab Lab: https://medium.com/opyn/crablab-bae31af13be6

Crab auction: https://medium.com/opyn/participating-in-the-squeeth-crab-auction-b75a1defd8d6

Squeeth LabIntroduction: https://medium.com/opyn/how-to-think-about-squeeth-returns-8646fd57f559

Squeeth Fundingand Liquidity: https://medium.com/opyn/squeeth-insides-volume-1-funding-and-volatility-f16bed146b7d

LP Collation: https://medium.com/opyn/lpeeeeeeth-demystifying-squeeth-lping-faee7e50ed33

Getting StartedGuide: https://medium.com/opyn/squeeth-primer-a-guide-to-understanding-opyns-implementation-of-squeeth-a0f5e8b95684

Squeeth doc: https://opyn.gitbook.io/squeeth/squeeth/contracts-documentation

Gamma doc: https://opyn.gitbook.io/opyn/getting-started/introduction

Greeks chart: https://pro.gvol.io/defi/squeeth/

Introduction to Power Perpetuals :

Disclaimer: The content of this article is for information and communication purposes only and does not constitute any investment advice. If there are obvious errors of understanding or data, welcome feedback. The content of this article was originally created by W3.Hitchhiker, please indicate the source if you need to reproduce.

Business cooperation: hello@w3hitchhiker.com

Official website: https://w3hitchhiker.com/

W3.Hitchhiker official Twitter: https://twitter.com/HitchhikerW3